Related articles

Everything to Know About Fire Insurance

Red Alert! Everything to Know About Your

Landed Property’s Fire Insurance

Do you ever worry about:

A flash flood destroying

your

home?

A landslide wiping away your hard-earned property and possessions?

A fire robbing everything you’ve built for your family?

If these things are keeping you up at night, we have just the answer to your woes.

When you purchase a home with a bank loan, you’re required to purchase Fire Insurance. Oftentimes it comes packaged in your bank loan and may include unnecessary coverage. But that’s not your only option! Did you know you can cancel your current insurance policy and purchase from any insurer?

WHY IS

SAFEHOME

THE

BEST ALTERNATIVE?

SafeHome is a reliable and hassle-free fire insurance from Touch ‘n Go eWallet to safeguard your property and/or its contents.

Provides coverage against losses or damages caused by fire and lightning.

Extra protection

against

other perils

like

floods,

subsidence,

or

landslides.

Offers cash relief and medical coverage in case of any mishaps due to insured perils.

With SafeHome, you can fully customise your coverage based on what you need and save on insurance premiums every year.

BUT HOW DO I KNOW

WHAT TO BUY?

The journey to choosing the right insurance policy

begins with these three questions:

Should I opt for

fire coverage only,

or include

other add-ons?

How can I save

on insurance

premiums?

In the event of a disaster,

will I be provided

inconvenience allowance

or medical reimbursement?

Once you have the basics, ask yourself:

how much do I want to insure?

We recommend utilising the PIAM calculator, as it can offer an estimation of the sum to be insured, empowering you to make informed decisions regarding your insurance policy.

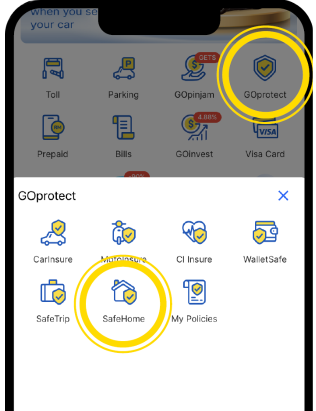

SWITCH TO SAFEHOME

IN 3 STEPS

Step 1:

Get a FREE quotation from SafeHome

to compare your

current policy with

potential benefits you may be

missing out on.

Step 2:

Once you’ve personalised your SafeHome policy, get a FREE cancellation note from us to cancel your current landed property policy.*

*If your submission is rejected by the bank,

we will

refund the premium paid.

Step 3:

Submit your cancellation and voila,

you’ll never have

to worry about

overpaying again!

Now that you know what to do,

let’s get you started!

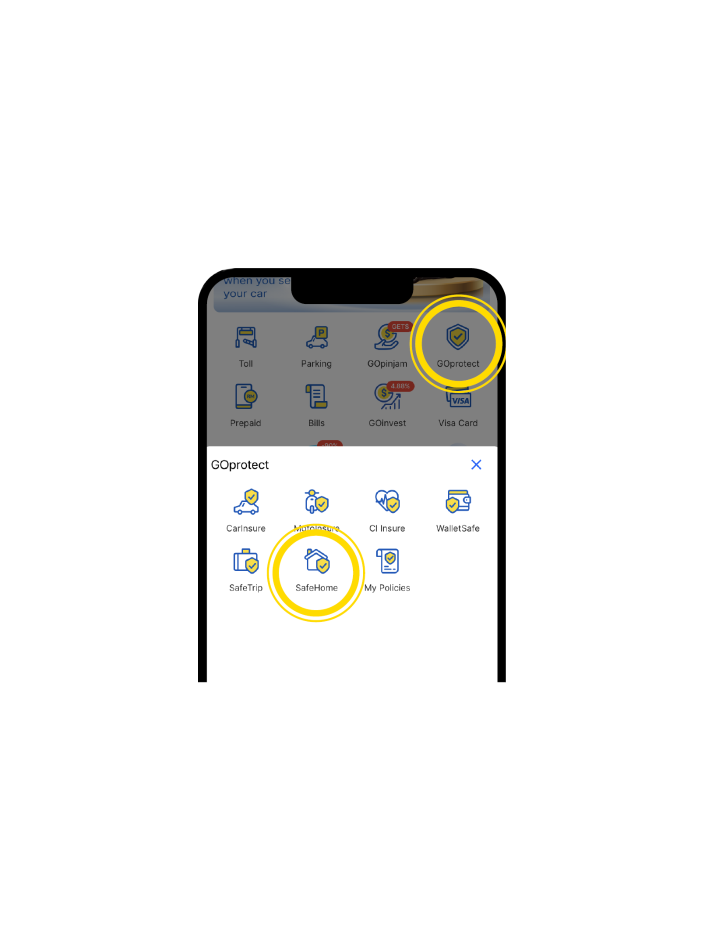

Just download the Touch ‘n Go eWallet app

to buy your customised SafeHome insurance policy online.

Red Alert! Everything to Know About Your

Landed Property’s Fire Insurance

Do you ever worry about:

1. A flash flood destroying your home?

2. A landslide wiping away your hard-earned property and possessions?

3. A fire robbing everything you’ve built for your family?

If these things are keeping you up at night, we have just the answer to your woes.

When you purchase a home with a bank loan, you’re required to purchase Fire Insurance. Oftentimes it comes packaged in your bank loan and may include unnecessary coverage. But that’s not your only option! Did you know you can cancel your current insurance policy and purchase from any insurer?

WHY IS

SAFEHOME

THE BEST ALTERNATIVE?

SafeHome is a reliable and hassle-free fire insurance from Touch ‘n Go eWallet to safeguard your property and/or its contents.

Provides coverage against losses or damages caused by fire and lightning.

Extra protection against other perils like floods, subsidence, or landslides.

Offers cash relief and medical coverage in case of any mishaps due to insured perils.

With SafeHome, you can fully customise your coverage based on what you need and save on insurance premiums every year.

BUT HOW DO I KNOW

WHAT TO BUY?

The journey to choosing the right insurance policy begins with these three questions:

1. Should I opt for fire coverage only, or include other add-ons?

2. In the event of a disaster, will I be provided inconvenience

allowance or medical reimbursement?

3. How can I save on insurance premiums?

Once you have the basics, ask yourself:

how much do I want to insure?

We recommend utilising the PIAM calculator, as it can offer an estimation of the sum to be insured, empowering you to make informed decisions regarding your insurance policy.

SWITCH TO SAFEHOME

IN 3 STEPS

Step 1:

Get a FREE quotation from SafeHome to compare your current policy with potential benefits you may be missing out on.

Step 2:

Once you’ve personalised your SafeHome policy, get a FREE cancellation note from us to cancel your current landed property policy.*

*If your submission is rejected by the bank, we will refund the premium paid.

Step 3:

With SafeHome, you can fully customise your coverage based on what you need and save on premiums every year.

Now that you know what to do, let’s get you started! Just download the Touch ‘n Go eWallet app to buy your customised SafeHome insurance policy online.