Related articles

What is Credit Score & How to Increase It

Credit Score 101

Did you know that your credit score affects your loan and credit card approvals? Here’s everything you need to know.

What Is A Credit Score?

A credit score is a value that depicts your loan or creditworthiness.

A higher credit score marks you as a less risky borrower, while a lower one indicates you have a bad history with loan-repayments, and that you are a potential high risk for banks or lenders.

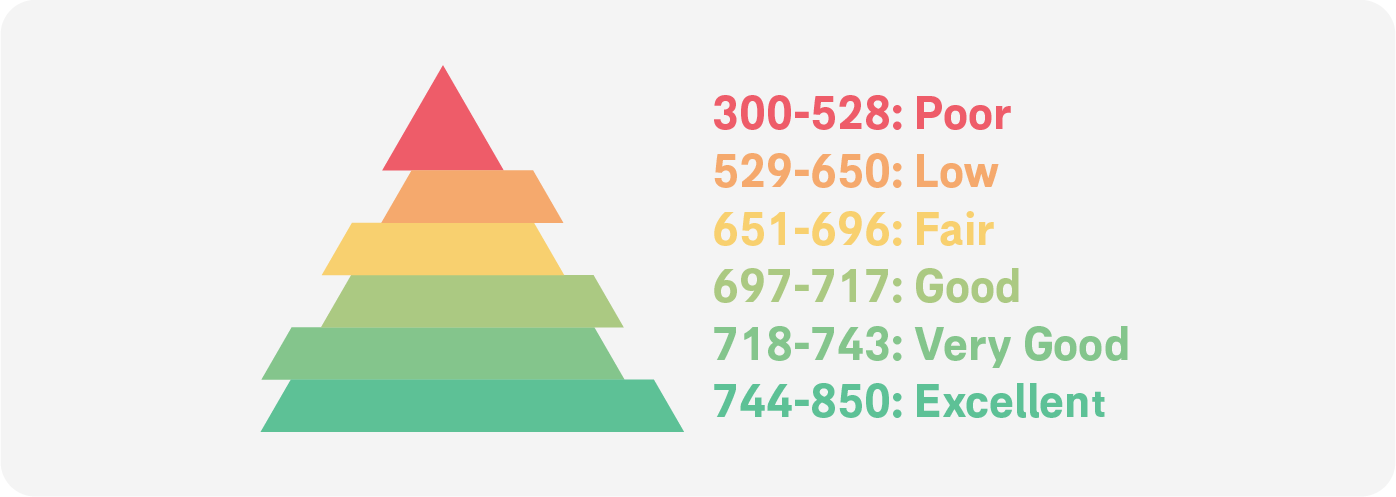

Values are usually around 300 to 850 and are attainable with the help of credit reporting agencies like Credit Bureau Malaysia, CTOS or RAMCI.

Agencies calculate the scores using their own proprietary model—which can only be obtained if the agency pays for a licence.

Benefits Of A Good Credit Score

1. Increases Your Chances Of Approval

Having a good credit score means you’re more likely to get your credit card or loan approved.

This is because it shows banks and lenders that you’re reliable and on top of all your payments, reducing your borrowing risks. In turn, it also reflects well on how you manage your savings and investments.

2. Saves Money On Interest Rates

A good credit score can get you better interest rates, which means better deals for you!

The higher your credit card or loan interest rates, the more money you’ll need to pay your bank or lender.

3. Boosts Your Negotiating Power

A good credit score shows that you’re capable of repaying your debts on time.

With a good credit score under your belt, you can negotiate better deals on interest rates and repayment plans.

How To Get A Good Credit Score

1. Pay Your Bills On Time

Being consistently on time with your payments such as loans, credit card bills, and insurance premiums help you build a good credit history. This is because it shows that you’re efficient and responsible when it comes to managing your finances.

2. Keeping A Long Credit History

A long and consistent history of paying your bills on time demonstrates reliability and financial responsibility. Lenders will have more confidence in your ability to manage debt, which can help boost your credit score and help them decide if you’re a good credit recipient.

3. Don’t Apply For Too Many Things At Once

Only apply for what you need. If you apply for many loans or credit cards in a short span of time, it gives banks or lenders the impression that you’re not in a stable financial situation.

What To Do If You Don’t Have A Good Credit Score

So, you may have lost track of your payments and your credit score has taken a hit because of it. How do you improve things from there?

What’s important is to ensure you repair your credit history instead of ignoring or putting it off. Avoid cancelling credit cards, creating more accounts, or other drastic measures. Focus instead on improving your overall financial habits, including setting aside savings for any potential investments to build better financial stability.

When you practise these good money habits, slowly but surely, you’ll be on your way to obtain a good credit score!

https://www.investopedia.com/terms/c/credit_score.asp

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/

https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-and-keep-a-good-credit-score-en-318/

https://ctoscredit.com.my/whats-your-ctos-score/

Credit Score 101

Did you know that your credit score affects your loan and credit card approvals? Here’s everything you need to know.

What Is A Credit Score?

A credit score is a value that depicts your loan or creditworthiness.

A higher credit score marks you as a less risky borrower, while a lower one indicates you have a bad history with loan-repayments, and that you are a potential high risk for banks or lenders.

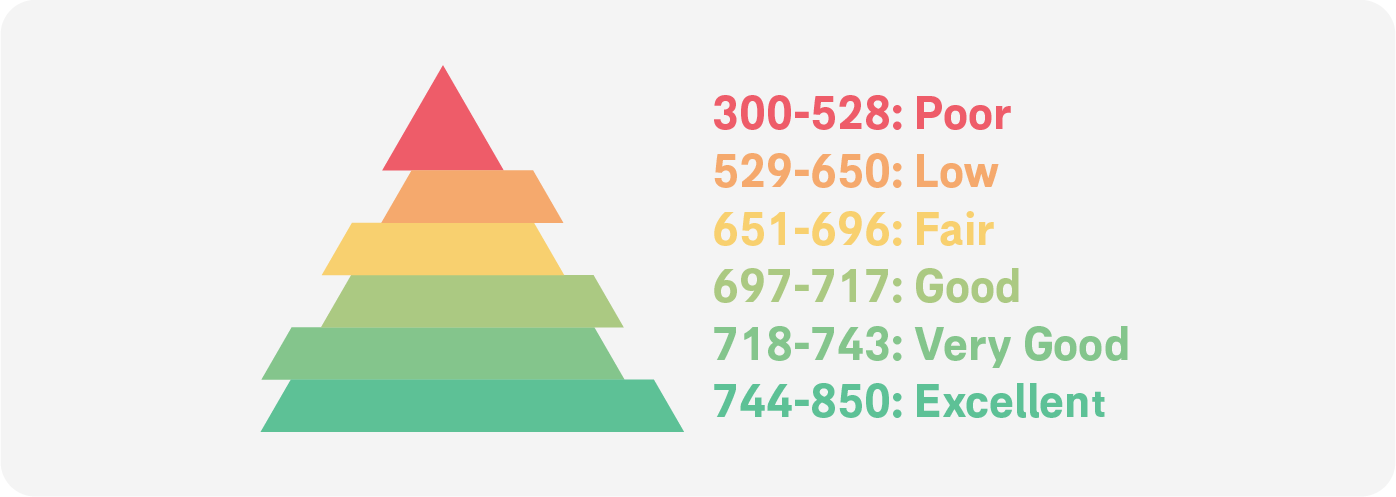

Values are usually around 300 to 850 and are attainable with the help of credit reporting agencies like Credit Bureau Malaysia, CTOS or RAMCI.

Agencies calculate the scores using their own proprietary model—which can only be obtained if the agency pays for a licence.

Benefits Of A Good Credit Score

1. Increases Your Chances Of Approval

Having a good credit score means you’re more likely to get your credit card or loan approved.

This is because it shows banks and lenders that you’re reliable and on top of all your payments, reducing your borrowing risks. In turn, it also reflects well on how you manage your savings and investments.

2. Saves Money On Interest Rates

A good credit score can get you better interest rates, which means better deals for you!

The higher your credit card or loan interest rates, the more money you’ll need to pay your bank or lender.

3. Boosts Your Negotiating Power

A good credit score shows that you’re capable of repaying your debts on time.

With a good credit score under your belt, you can negotiate better deals on interest rates and repayment plans.

How To Get A Good Credit Score

1. Pay Your Bills On Time

Being consistently on time with your payments such as loans, credit card bills, and insurance premiums help you build a good credit history. This is because it shows that you’re efficient and responsible when it comes to managing your finances.

2. Keeping A Long Credit History

A long and consistent history of paying your bills on time demonstrates reliability and financial responsibility. Lenders will have more confidence in your ability to manage debt, which can help boost your credit score and help them decide if you’re a good credit recipient.

3. Don’t Apply For Too Many Things At Once

Only apply for what you need. If you apply for many loans or credit cards in a short span of time, it gives banks or lenders the impression that you’re not in a stable financial situation.

What To Do If You Don’t Have A Good Credit Score

So, you may have lost track of your payments and your credit score has taken a hit because of it. How do you improve things from there?

What’s important is to ensure you repair your credit history instead of ignoring or putting it off. Avoid cancelling credit cards, creating more accounts, or other drastic measures. Focus instead on improving your overall financial habits, including setting aside savings for any potential investments to build better financial stability.

When you practise these good money habits, slowly but surely, you’ll be on your way to obtain a good credit score!

https://www.investopedia.com/terms/c/credit_score.asp

https://www.experian.com/blogs/ask-experian/credit-education/score-basics/

https://www.consumerfinance.gov/ask-cfpb/how-do-i-get-and-keep-a-good-credit-score-en-318/

https://ctoscredit.com.my/whats-your-ctos-score/