Related articles

Rising Inflation - How Does it Affect You & I?

Rising Inflation

and How It Affects You

- Inflation simply refers to the rate of increase in

prices of goods and services over a period of

time.

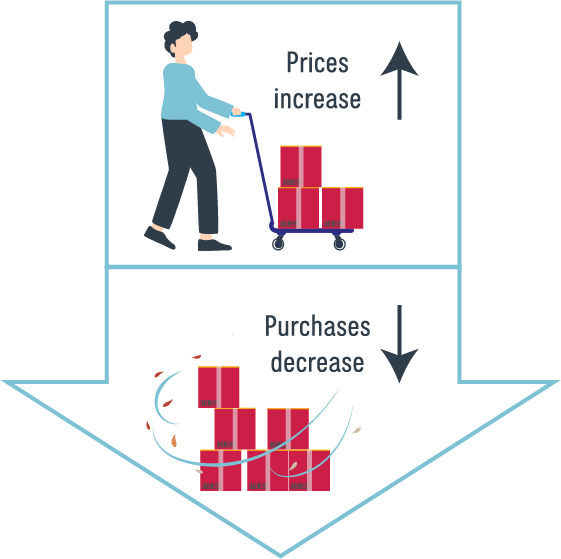

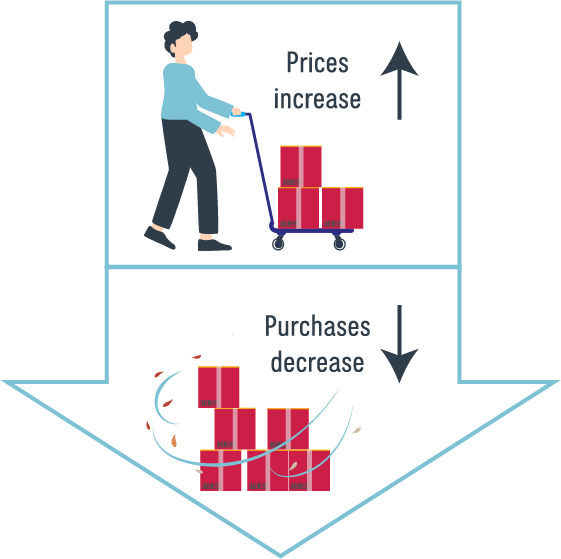

- Closely related to an increase in the cost of living, inflation often results in the decline of consumer purchasing power over a period of time with the same amount of money. For example, RM10 today buys less than it did in the 1980's.

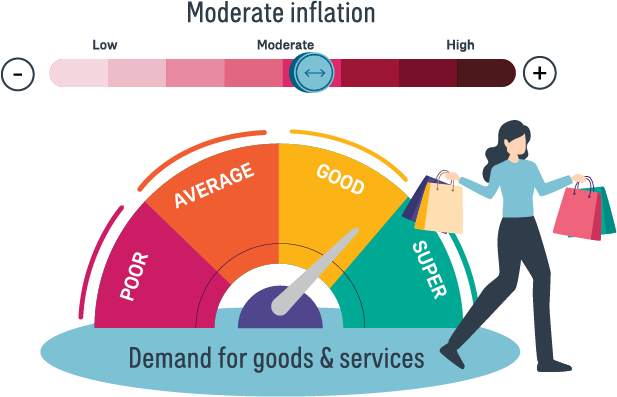

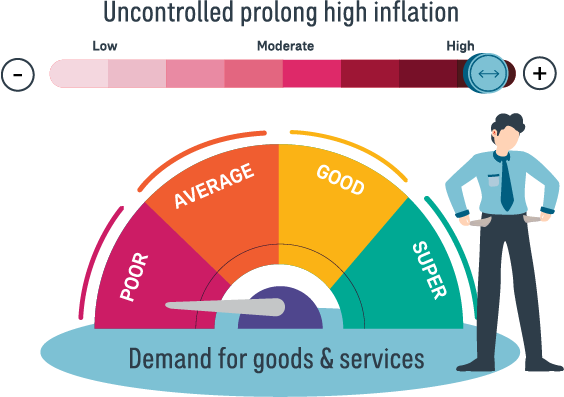

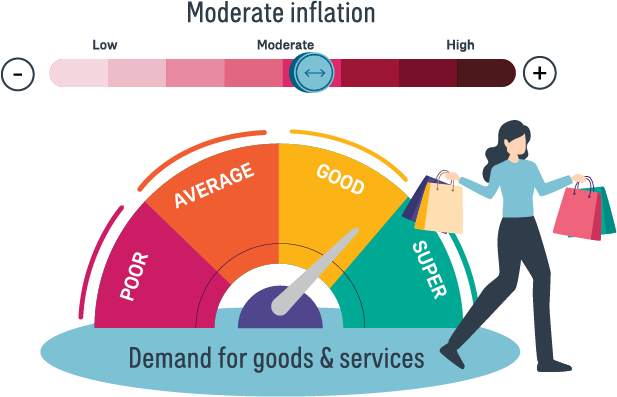

Most economists believe that moderate inflation is good for the economy as it promotes spending which results in the increased demand for goods and services, which in turn triggers higher production and drives the economy forward.

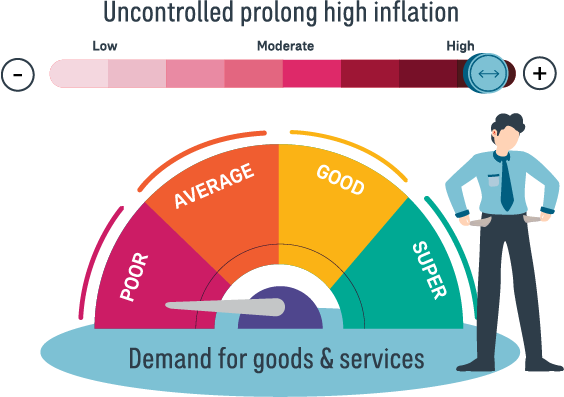

Uncontrolled and prolonged high inflation on the other hand hurts the economy as the purchasing power of the consumer is reduced, making goods and services unaffordable. This results in a lower demand and slowing of the economy. In such a situation, consumers would need to save and spend wisely and consider an "inflationary proof" financial plan such as a long-term savings plan to achieve their savings and protection goals.

WHY IS INFLATION ON THE RISE

AND

WHAT CAN YOU DO ABOUT

IT?

Key factors that are keeping inflation rates elevated across the world:

Recovery of economic activities and consumption

Drastic increase of commodity prices and material prices

Constraints in global supply chain impacted by Covid-19

You should consider these options to help your savings and investments to weather through an expected increase in inflation :

Review your protection and financial standing through our Financial Health Check

to ensure sufficient protection coverage and savings.

Reassess your spending habits

Dealing with inflation can be immensely stressful. With everything priced a lot higher these days, it is important to keep tab on your expenditures and follow a strict spending plan every month. Cutting down expenditures on non-essential items will help you save, which will come in handy in the long run. So, re-examine your needs and wants to help you stretch your ringgit a little longer.

Practice Portfolio Diversification

and build your long-term savings goals with dollar-cost averaging while staying invested in the market.

Rising Inflation

and How It Affects You

- Inflation simply refers to the rate of increase in prices of goods and services over a period of time.

- Closely related to an increase in the cost of living, inflation often results in the decline of consumer purchasing power over a period of time with the same amount of money. For example, RM10 today buys less than it did in the 1980's.

Most economists believe that moderate inflation is good for the economy as it promotes spending which results in the increased demand for goods and services, which in turn triggers higher production and drives the economy forward.

Uncontrolled and prolonged high inflation on the other hand hurts the economy as the purchasing power of the consumer is reduced, making goods and services unaffordable. This results in a lower demand and slowing of the economy. In such a situation, consumers would need to save and spend wisely and consider an "inflationary proof" financial plan such as a long-term savings plan to achieve their savings and protection goals.

WHY IS INFLATION ON THE RISE

AND

WHAT CAN YOU DO ABOUT IT?

Key factors that are keeping inflation rates elevated across the world:

Recovery of economic activities and consumption

Drastic increase of commodity prices and material prices

Constraints in global supply chain impacted by Covid-19

You should consider these options to help your savings and investments to weather through an expected increase in inflation :

Review your protection and financial standing through our Financial Health Check

to ensure sufficient protection coverage and savings.

Reassess your spending habits

Dealing with inflation can be immensely stressful. With everything priced a lot higher these days, it is important to keep tab on your expenditures and follow a strict spending plan every month. Cutting down expenditures on non-essential items will help you save, which will come in handy in the long run. So, re-examine your needs and wants to help you stretch your ringgit a little longer.

Practice Portfolio Diversification

and build your long-term savings goals with dollar-cost averaging while staying invested in the market.