Related articles

Term Life vs. Whole Life Policy

Term Life vs. Whole Life Policy:

Everything You Need to Know

Term life? Whole life? How do you determine which type of insurance plan is suited for your life? Here’s a breakdown of all the key differences to help you make the best decision.

What are the differences between

Term Life and Whole Life Insurance Policy?

Term Life

Whole Life

Length of Coverage

Provides coverage for a set period of time – e.g. between a period of 5 - 30 years, covering you until you’re 80 years old.

Provides coverage throughout a person’s lifetime (up to 100 years).

Cost to Maintain

The least expensive form of life insurance that covers you for a fixed period.

Premium payments are higher than Term Life Insurance policies as Whole Life Policy provides coverage throughout a person’s lifetime.

Cash Value/Return

The most basic policy with no cash value (i.e. no returns on maturity/no minimal surrender value).

Offers cash value/returns upon maturity or surrender of policy.

Minimum Sum Purchasable

RM25,000

RM20,000

Eligibility

Individuals aged 16 years and above.

Individuals aged between 14 days to 65* years old.

*For TPD, the maximum entry age is 60 years old.

Income Tax Relief

Yes

What It Provides

Basic Life Insurance Coverage

Offers some financial support to your loved ones when you pass away. There’s also the option to add coverage for Total & Permanent Disability (TPD), depending on the type of plan you purchase.

Comprehensive Life Insurance Coverage

Provides your loved ones a lump sum payment when you pass away. If you suffer Total & Permanent Disability (TPD), you will receive a lump sum payment.

Choice of Coverage Plans

Level Term Plan, 5-Year Term Plan or Yearly Renewable Plan? The choice is yours, depending on your affordability and desired length of coverage!

Lifelong

Insurance

Coverage

Depending on your plan, you may be covered until you’re 100 years old!

Guaranteed Renewal

If you’ve purchased a 5-Year Term Plan or a Yearly Renewable Term Plan, then you’ve just saved yourself the hassle of going through the underwriting process again.

Maturity Payment

Receive a lump sum payment for the amount you are covered for when your plan matures.

Conversion Flexibility

Got a change of heart? Easily convert this plan to another permanent life policy (except for policies that provide critical illness coverage) without undergoing the underwriting process again.

Guaranteed Cash Value

Once you’re on this plan for more than three years, you will be able to accumulate a guaranteed cash value throughout the term of your policy.

What should you take into consideration

before making a decision?

1.

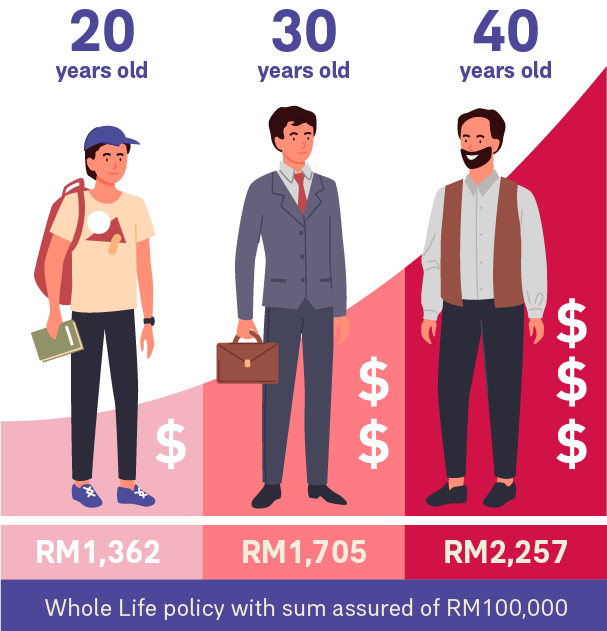

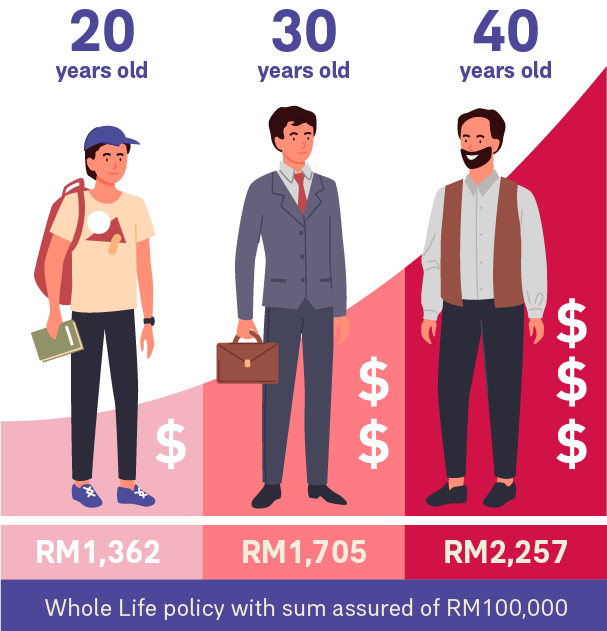

Your Current Age

The longer you wait to get a plan, the higher your annual premium rate will be.

For example, a Whole Life Policy for a non-smoker male of standard health with a sum assured of RM100,000 can be RM1,362 (at 20 years old), RM1,705 (at 30 years old) and RM2,257 (at 40 years old).

2.

Your Current

Health Status

A clean bill of health will always be the most important currency, so don’t lose interest in your own well-being. Schedule your health screens regularly, and if something crops up, nip it in the bud.

3.

Your Children’s Age

Are your kids still tiny tots or are they old enough to leave the nest?

As a parent, your financial commitment would most likely fluctuate depending on the age of your kids, so you’ll want to factor that in before you fully commit to a new expense.

4.

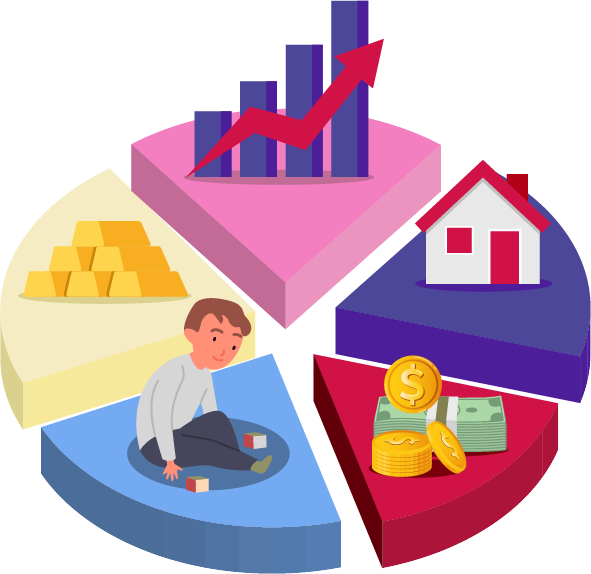

Financial Debt and

Commitments

Do you already have a lot on your plate? Will you be able to sustain this policy?

Keep track of your monthly expenses. From major ones like house or car loans, to the miscellaneous expenses like your online subscriptions—be reasonable with your budget and invest in a policy that’s within your comfort zone.

5.

Future Plans for Funeral

and Death

Expenses

Even without the financial woes, life-threatening illnesses or death of a loved one can really send a family into disarray.

So, don’t put yours through that turmoil. Lock down a lifelong protection plan that’ll provide your family with a financial safety net if the unexpected happens to you.

Should I Go for a Term Life or

a Whole Life Insurance Policy?

Consider your commitments and think about the stage of life that you’re currently in. Where do you want to be in the future? Take the next step and protect your life with our range of Life Protection Plans or contact us.

Term Life vs. Whole Life Policy:

Everything You Need to Know

Term life? Whole life? How do you determine which type of insurance plan is suited for your life? Here’s a breakdown of all the key differences to help you make the best decision.

What are the differences between Term Life and Whole Life Insurance Policy?

Length of Coverage

Term Life

Provides coverage for a set period of time – e.g. between a period of 5 - 30 years, covering you until you’re 80 years old.

Whole Life

Provides

coverage throughout a person’s

lifetime

(up to 100 years).

Cost to Maintain

Term Life

The least expensive form of life insurance that covers you for a fixed period.

Whole Life

Premium payments are higher than Term Life Insurance policies as Whole Life Policy provides coverage throughout a person’s lifetime.

Cash Value/Return

Term Life

The most basic policy with no cash value (i.e. no returns on maturity/no minimal surrender value).

Whole Life

Offers cash value/return upon maturity or surrender of policy.

Minimum Sum Purchasable

Term Life

RM25,000

Whole Life

RM20,000

Eligibility

Term Life

Individuals aged 16 years and above.

Whole Life

Individuals aged between 14 days to 65* years old.

*For TPD, the maximum entry age is 60 years old.

Income Tax Relief

Term Life

Yes

Whole Life

Yes

What It Provides

Term Life

Basic Life Insurance Coverage

Offers some financial support to your loved ones when you pass away. There’s also the option to add coverage for Total & Permanent Disability (TPD), depending on the type of plan you purchase.

Choice of Coverage Plans

Level Term Plan, 5-Year Term Plan or Yearly Renewable Plan? The choice is yours, depending on your affordability and desired length of coverage!

Guaranteed Renewal

If you’ve purchased a 5-Year Term Plan or a Yearly Renewable Term Plan, then you’ve just saved yourself the hassle of going through the underwriting process again.

Conversion Flexibility

Got a change of heart? Easily convert this plan to another permanent life policy (except for policies that provide critical illness coverage) without undergoing the underwriting process again.

Whole Life

Comprehensive

Life

Insurance

Coverage

Provides your loved ones a lump sum payment when you pass away. If you suffer Total & Permanent Disability (TPD), you will receive a lump sum payment.

Lifelong

Insurance

Coverage

Depending on your plan, you may be covered until you’re 100 years old!

Maturity Payment

Receive a lump sum payment for the amount you are covered for when your plan matures.

Guaranteed Cash Value

Once you’re on this plan for more than three years, you will be able to accumulate a guaranteed cash value throughout the term of your policy.

What should you take into consideration before making a decision?

1.

Your Current Age

The longer you wait to get a plan, the higher your annual premium rate will be.

For example, a Whole Life Policy for a non-smoker male of standard health with a sum assured of RM100,000 can be RM1,362 (at 20 years old), RM1,705 (at 30 years old) and RM2,257 (at 40 years old).

2.

Your Current

Health Status

A clean bill of health will always be the most important currency, so don’t lose interest in your own well-being. Schedule your health screens regularly, and if something crops up, nip it in the bud.

3.

Your Children’s Age

Are your kids still tiny tots or are they old enough to leave the nest?

As a parent, your financial commitment would most likely fluctuate depending on the age of your kids, so you’ll want to factor that in before you fully commit to a new expense.

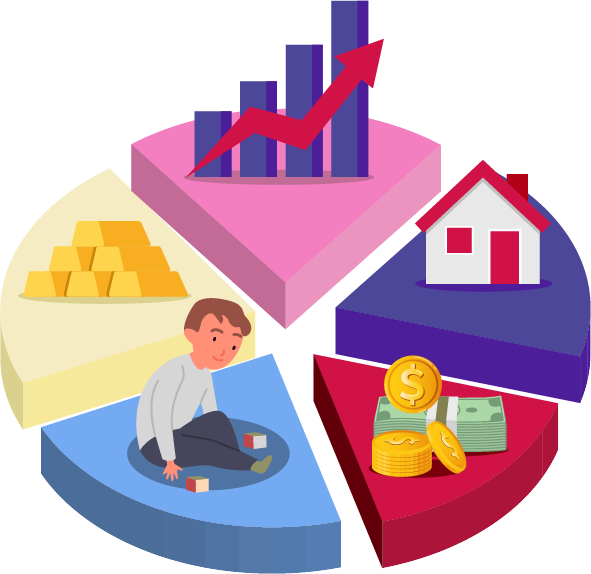

4.

Financial Debt and

Commitments

Do you already have a lot on your plate? Will you be able to sustain this policy?

Keep track of your monthly expenses. From major ones like house or car loans, to the miscellaneous expenses like your online subscriptions—be reasonable with your budget and invest in a policy that’s within your comfort zone.

5.

Future Plans for Funeral

and Death Expenses

Even without the financial woes, life-threatening illnesses or death of a loved one can really send a family into disarray.

So, don’t put yours

through that turmoil.

Lock

down a lifelong protection plan that’ll

provide your family with a financial safety net

if the unexpected happens to you.

Should I Go for a Term Life or a Whole Life Insurance Policy?

Consider your commitments and think about the stage of life that you’re currently in. Where do you want to be in the future? Take the next step and protect your life with our range of Life Protection Plans or contact us.