Related articles

The Importance Of Fire & Home Insurance

THINK YOUR HOME IS SAFE?

THINK AGAIN.

Here's why Fire Insurance is a no-brainer.

Imagine this:

You return home from a vacation, after escaping from the stresses of life. However, you are struck with devastation as your home has been completely destroyed by a fire. All your possessions, memories and sense of security reduced to ash.

It’s raining season, and suddenly water pours into your home. Furniture floats around you as your prized possessions are destroyed. You wonder how you will recover from this.

A landslide swallows your home completely. Amidst the chaos, you find cracked walls, the roof caved in under the weight of debris and your family members injured.

Do you have sufficient funds to cover temporary shelter and home repairs, or even medical family insurance to cover the bills for the family?

In scenarios like these, having fire and home insurance can make all the difference!

Did you know

Fire Insurance does not only cover fire incidents but also...

Lightning

Flood

Landslide

And other perils

It is important to understand the specifics of your coverage so you are not caught off guard when trying to file your insurance claim. Make sure you know what is covered and what is not before disaster strikes.

HOW DO I KNOW WHAT TO PROTECT?

It depends on the type of home you live in.

If you live in a landed property

(i.e.

bungalow, terrace, semi-detached house)

Is your home built on full brick or partial brick?

Full

brick

Made of solid brick,

cement &

concrete floors. (i.e.,

layered

with parquet, vinyl, wooden

or

other types of floor

layering)

Partial

brick

Made partially of brick,

concrete, wood, and/or

glass.

Normally, full brick properties are only insured since partial brick properties have higher risks of getting damaged

If you live in a high-rise property

(i.e. condominium, apartment,

flat)

Depending on your property type, your home may have fire insurance purchased by the Joint Management Body (JMB). However, this only covers the damage of the building, not your belongings in your home.

This is why it is always recommended for you to insure the contents of your home, including furniture and electronic appliances, so that you could repurchase them if an unfortunate event were to happen.

It is also a good idea to review your family insurance to make sure you are fully covered in the event of any medical needs arising from an emergency.

In summary...

Landed

Property

Always remember to only

insure the

rebuilding cost and

not the

market value of your house.

High-rise

Property

The building is insured by

JMB but

not your personal

belongings

within.

How

much should I insure

my

home

for?

You can use the calculator

provided by PIAM (Persatuan

Insurans Am Malaysia) by

clicking

here.

Finally, make sure your fire and

home insurance include these:

Cash to rebuild your home

after the

damage

Cash to repurchase the furniture in your home

Cash to temporarily relocate

your

families to a safer

place

Cash for medical treatment

for any

injury occurred

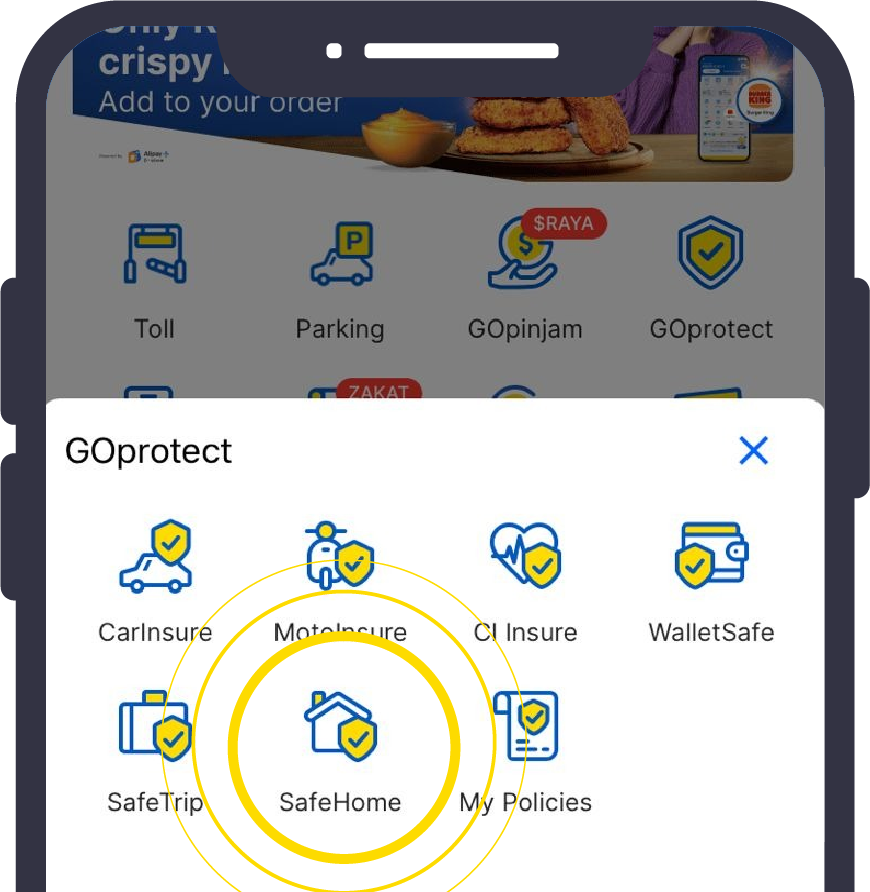

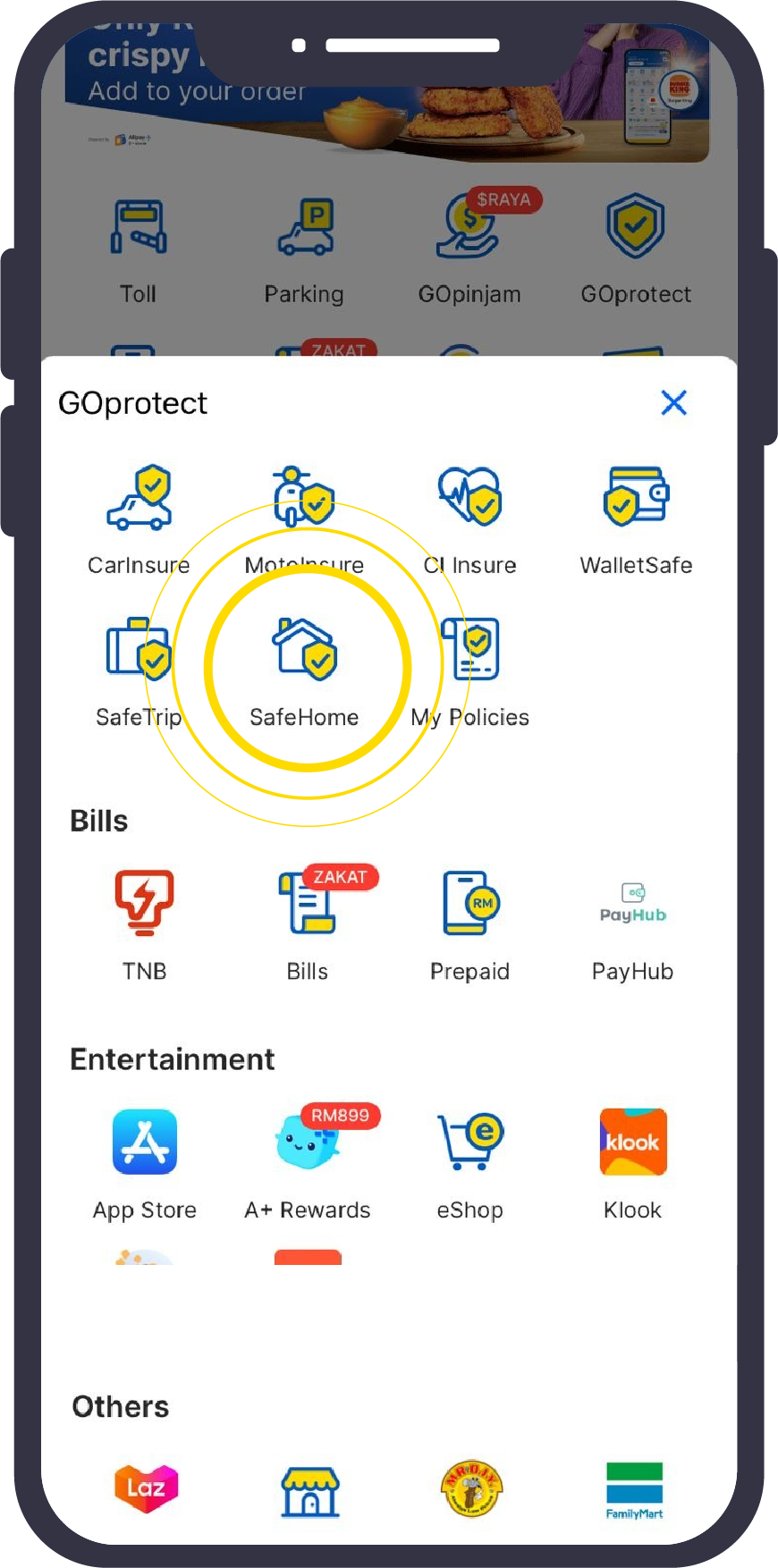

Now that you know all about fire insurance, head over to your Touch 'n Go eWallet app to get SafeHome! The only plan that allows you to customise your coverage and pay for only what you need.

Start protecting your home now before it's too late.

Think your home is safe? think again.

Here's why Fire Insurance is a no-brainer.

Imagine this:

You return home from a vacation, after escaping from the stresses of life. However, you are struck with devastation as your home has been completely destroyed by a fire. All your possessions, memories and sense of security reduced to ash.

It’s raining season, and suddenly water pours into your home. Furniture floats around you as your prized possessions are destroyed. You wonder how you will recover from this.

A landslide swallows your home completely. Amidst the chaos, you find cracked walls, the roof caved in under the weight of debris and your family members injured.

Do you have sufficient funds to cover temporary shelter and home repairs, or even medical family insurance to cover the bills for the family?

In scenarios like these, having fire and home insurance can make all the difference!

Did you know

Fire Insurance does not only cover fire incidents but also...

Lightning

Flood

Landslide

And other perils

It is important to understand the specifics of your coverage so you are not caught off guard when trying to file your insurance claim. Make sure you know what is covered and what is not before disaster strikes.

HOW DO I KNOW WHAT TO PROTECT?

It depends on the type of home you live in.

If you live in landed property

(i.e. bungalow, terrace,

semi-detached house)

Is your home built on full brick or partial brick?

Full brick

Made of solid

brick, cement & concrete floors. (i.e., layered with

parquet, vinyl, wooden or other types of floor layering)

Partial brick

Made

partially of brick, concrete, wood, and/or glass.

Normally, full brick properties are only insured since partial brick properties have higher risks of getting damaged

If you live in a high-rise property

(i.e. condominium,

apartment, flat)

Depending on your property type, your home may have fire insurance purchased by the Joint Management Body (JMB). However, this only covers the damage of the building, not your belongings in your home.

This is why it is always recommended for you to insure the contents of your home, including furniture and electronic appliances, so that you could repurchase them if an unfortunate event were to happen.

It is also a good idea to review your family insurance to make sure you are fully covered in the event of any medical needs arising from an emergency.

In summary...

Landed

Property

Always

remember to only insure the rebuilding

cost and not the market value of

your house.

High-rise

Property

The building

is insured by JMB but not your personal

belongings within.

How much should I insure my home for?

To

get a clearer picture, you can use the calculator provided by PIAM

(Persatuan Insurans Am Malaysia) by clicking here.

Finally, make sure your fire and home insurance include these

Cash to rebuild your home after the damage

Cash to repurchase the furniture in your home

Cash to temporarily relocate your families to a safer place

Cash for medical treatment for any injury occurred

Now that you know all about fire insurance, head over to your Touch 'n Go eWallet app to get SafeHome! The only plan that allows you to customise your coverage and pay for only what you need.

Start protecting your home now before it's too late.