Life Protection

Protect yourself and your loved ones from life's uncertainties with AIA's life insurance and takaful plans.

{{title}}

{{label}}The Free Income Cover provides a daily hospital cash allowance for Malaysians who have been hospitalised and are unable to work due to an accident or an infectious disease diagnosis. This cover is available for those who have been hospitalised for at least 3 consecutive days, up to 14 days in total.

Table of Benefits

|

Daily Hospital Cash Allowance (up to 14 days in total) |

AIA+ app User |

Non-AIA+ app User |

|

For normal ward admission |

RM100 per day |

RM50 per day |

| For Intensive Care Unit (ICU) admission |

RM200 per day |

RM100 per day |

List of Infectious Diseases:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Description of the benefit:

| Daily Hospital Cash Allowance for admission into normal ward or ICU |

|

When by reason of Injury or diagnosis of an Infectious Disease, the Covered Person requires Confinement in a Hospital for at least three (3) consecutive days (in normal ward and/or in ICU), We shall pay the amount of benefit as shown in the Table of Benefits for each day of hospitalisation, up to a maximum of fourteen (14) days from the date of Accident or Infectious Disease, in respect of one (1) Confinement. Consecutive hospitalisations resulting from the same Injury shall be considered as one (1) Confinement.

All Daily Hospital Allowance claims must be evidenced and supported by Hospital admission and discharge certification and/or original medical bill(s). |

Notes:

1. AIA+ app user/non-AIA+ app user status of the Covered Person at point of claims will be used to determine the benefit amount payable.

2. Each Covered Person is limited to signing up for this Free Income Cover only ONCE during the coverage period.

3. During the coverage period, only 1 accidental/infectious disease event is covered. The Covered Person can claim from all 2 benefits if the claim events are caused by a single accident/ infectious disease only. These benefits require a minimum confinement in hospital of at least 3 consecutive days. There is no waiting period for accident events; however, the 14 days waiting period for infectious disease diagnosis applies.

4. This free coverage is subject to a total claim limit of RM 1million (aggregated between all the free covers offered by AIA Bhd., AIA PUBLIC Takaful Bhd., and AIA General Berhad).

5. Please refer to Appendix 1 for the definition of the capitalized terms.

6. Please refer to Question 10 for the exclusions to Free Income Cover.

You can sign up for this free coverage from 1 October until 31 December 2023.

To be eligible for this free coverage, the customer needs to be:

a) A Malaysian citizen residing in Malaysia; and

b) Between the age of 18 and 55.

You can reach out to any AIA Life Planner to sign up through the dedicated microsite.

Provide the relevant information below via the dedicated microsite during the registration period:

If you do not know any AIA Life Planner, please email us at MY.Customer@aia.com and provide your Name, Contact No. and Current Location (e.g., Kepong, Kuala Lumpur) and include “Free Income Cover” in the email subject.

The coverage period of this Free Income Cover is effective upon successful registration, subject to 14 days waiting period for infectious disease events, until 31 January 2024, or upon reaching a total claims limit of RM1 million (for AIA Bhd., AIA PUBLIC Takaful Bhd., and AIA General Berhad, combined), whichever is earlier. The total claims limit of RM1 million is aggregated between all the free covers which are offered by Us. AIA reserves the right to withdraw this Free Income Cover at any time with prior notice.

No. The coverage is only eligible for Malaysians residing in Malaysia only.

Yes. The hospitalisation requirement for at least 3 consecutive days is based on total number of days in normal ward and ICU.

You can claim Daily Hospital Cash Allowance up to 14 days in total and the total claim amount is RM1,600 and the breakdown is as per below:

Normal ward admission: RM100 per day X 12 days = RM1,200

ICU admission: RM200 per day X 2 days = RM400

The payout amount is based on the type of admission for first 14 days.

No. Each coverage period can only claim for one accident event or one infectious disease diagnosis only.

Yes. This Free Income Cover does not cover any accidental claim where the basis of the claim is caused directly or indirectly, wholly or partly by any of the following:

1. war, invasion, act of foreign enemy hostilities or warlike operations (whether war be declared or not), mutiny, civil war, rebellion, revolution, insurrection, conspiracy, military or usurped power, martial law, or state of emergency;

2. while the Covered Person is serving in the armed forces of any country or international authority, whether in peace or war;

3. resistance to arrest, violation or attempt of violation of the law including but not limited to riding or driving without a valid license;

4. suicide or self-destruction or any attempt thereat or self-inflicted Injury while sane or insane;

5. mental or nervous disorders;

6. while the Covered Person is under the influence of alcohol or use of drugs/narcotics of any kind (other than those taken in accordance with treatment prescribed and directly by a Registered Medical Practitioner, but not for the treatment of drug or alcohol addiction);

7. pregnancy, childbirth or miscarriage, or any complications therefrom;

8. any congenital anomalies and conditions arising out of or resulting therefrom;

9. bacterial, viral or fungal infections (except pyogenic infections which shall occur through an accidental cut or wound and Infectious Disease covered in the respective benefits under this Policy);

10. medical or surgical treatment (except as necessitated by Injury and Infectious Disease covered in the respective benefits under this Policy);

11. dental treatment (except as necessitated by Injury for extraction of sound and natural teeth);

12. any kind of disease or sickness, including but not limited to Acquired Immune Deficiency Syndrome (AIDS), Human immunodeficiency Virus (HIV), Encephalopathy (dementia) and HIV Wasting Syndrome;

13. entering, operating, or servicing, riding in or on, ascending or descending from or with any aerial device or conveyance as an operator/pilot or crew member, except while the Covered Person is riding as a fare-paying passenger in an aircraft operated by:

(a) a commercial passenger airline on a regular schedule passenger trip over its established passenger route; or

(b) aircraft having a current and valid airworthiness certificate.

14. engaging in a sport in a professional capacity or where the Covered Person would or could earn income or remuneration from engaging in such sport;

15. racing of any kind; or

16. engaging in any Hazardous Activity.

Note: Please refer to Appendix 1 for the definition of the capitalized terms.

Your Free Income Cover will commence on the day your registration on the microsite is successful. If your application is successful, you will receive a welcome email within 14 working days from the registration date.

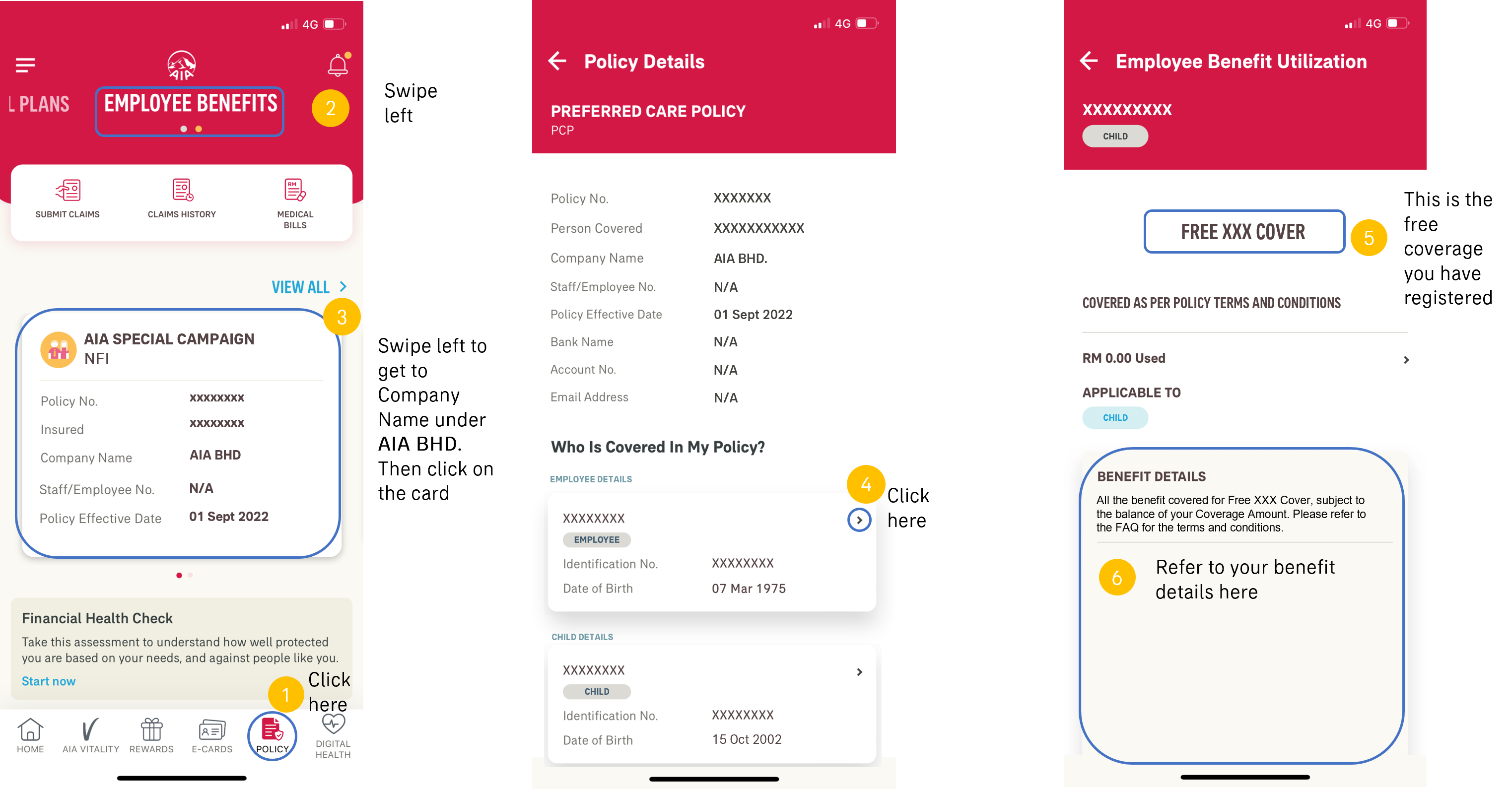

You will then be required to download the AIA+ mobile app via Google Play, App Store or Huawei App Gallery and register your AIA+ account. Once completed, you may view your benefits via the AIA+ app. You are highly encouraged to download the AIA+ mobile app to enjoy higher coverage for this Free Income Cover.

Do not worry. This is where you can view details of your Free Income Cover in the AIA+ app.

Follow the guide below and you will be able to see that your coverage is shown (point 6) below:

Please ensure that you have provided the correct information via the dedicated microsite when you sign up for this free coverage, including full name as per NRIC, NRIC Number, phone number and e-mail address.

If you are unsure, please resubmit the application with the correct information and contact your respective AIA Life Planner or e-mail MY.Customer@aia.com and include “Free Income Cover” in the email subject for assistance.

Table of Documents

List of documents required when submitting a claim:

|

Documents |

|

Note:

1. Claim must be submitted within 60 days from the accident/ diagnosis date.

2. We may request additional information and/or supporting documents when required; your early response will expedite the processing of your claim.

One of the reasons is you may have provided incorrect information during the claims application. Please resubmit the claim application with the correct information and contact your respective Life Planner or email MY.Customer@aia.com for assistance.

All ages referred to under this free coverage shall be the age of Covered Person’s last birthday.

“Accident” means a sudden, unintentional, unexpected, unusual, and specific event that occurs at an identifiable time and place which shall, independently of any other cause, be the sole cause of bodily Injury.

“Confinement” or “Confined in a Hospital” shall mean admission in a Hospital for a minimum period of six (6) hours upon the recommendation of a Physician and continuous stay in the Hospital prior to the Covered Person’s discharge. Confinement shall be evidenced by a daily room/room and board charged by the Hospital.

“Hospital” shall mean only an establishment duly constituted and registered as a Hospital for the care and treatment of sick and injured persons as paying bed-patients, and which:

(a) has facilities for diagnosis and major surgery;

(b) provides twenty four (24) hour a day nursing services by registered and Graduate Nurses;

(c) is under the supervision of a Physician; and

(d) is not primarily a clinic; a place for alcoholics or drug addicts; a nursing, rest or convalescent home or a home for the aged or similar establishment.

“Infectious Disease” means any of the covered Infectious Diseases listed below that:

(a) first started and was first contracted, where physical signs and symptoms are first displayed after fourteen (14) days from the Registration Date, whichever is later; and

(b) was diagnosed by a Registered Medical Practitioner using internationally accepted medical diagnostic criterion, with acceptable clinical, radiological, histological and laboratory evidence.

List of Covered Infectious Diseases are:

“Injury” means bodily Injury caused solely by Accident.

“Covered Person” shall mean the person(s) covered whom must meet the following eligibility and has/have successfully applied for this free coverage:

“Intensive Care Unit” (ICU) means a section within a Hospital which is designated as an Intensive Care Unit by the Hospital, and which is maintained on a twenty-four (24) hour basis solely for treatment of patients in critical condition and is equipped to provide special nursing and medical services not available elsewhere in the Hospital.

“Issue Date” or “Commencement Date” is the policy effective date as stated in AIA+ app and is the date when coverage under this Policy takes effect.

“Licensed Nurse” or “Graduate Nurse” shall mean any person that upon successful completion of a recognised college or school of nursing, is legally authorised by the government of the geographical area of his/her practice to render nursing services, but excluding a Licensed Nurse or Graduate Nurse who is the Covered Person or Owner himself, an insurance agent/authorised insurance intermediary, business partner(s) or employer/employee of the Covered Person/Owner or a member of the Covered Person’s immediate family or related in similar fashion to the Owner.

“Physician”, “Registered Medical Practitioner” or “Surgeon” shall mean any person qualified by degree in western medicine and who is legally authorised in the geographical area of his practice to practise medicine and surgery, but excluding the Covered Person or Owner himself, an insurance agent/authorised insurance intermediary, business partner(s) or employer/employee of the Covered Person or Owner or a member of the Covered Person’s immediate family or related in similar fashion to the Owner.

Whenever the context requires, masculine form shall apply to feminine and singular term shall include the plural.