Life Protection

Protect yourself and your loved ones from life's uncertainties with AIA's life insurance and takaful plans.

{{title}}

{{label}}The Free Lifestyle Sports Cover provides the following coverage benefits when you are participating in recreational sports activities in your leisure time in Malaysia.

Table of Benefits

|

Benefits |

My AIA app User |

Non-My AIA app User |

|

Accidental Death and Dismemberment |

RM5,000 |

RM2,500 |

| Medical Reimbursement | Up to RM500 | Up to RM250 |

| Daily Hospital Income | RM50 per day, up to 30 days | N/A |

Description of the benefits listed below:

|

Benefits |

Descriptions |

|

Accidental Death & Dismemberment Benefit |

When by reason of injury (i.e. only when carrying out the recreational sports activities for leisure purpose within Malaysia) the Covered Person suffers any of the events stipulated below, we shall pay the amount of benefit as shown in the Table of Benefits above:

|

| Accidental Medical Reimbursement |

When by reason of Injury (i.e. only when carrying out the recreational sports activities for leisure purpose within Malaysia) the Covered Person requires treatment by a Registered Medical Practitioner or Surgeon, Confinement in a Hospital or the employment of a Licensed Nurse or Graduate Nurse, We shall reimburse the Reasonable and Customary expenses incurred within thirty (30) days from the date of Accident for such medical treatment, surgery, Hospital charges, nursing fees, medical/specialist report fees and ambulance fees, but not to exceed the amount of benefit as shown in the Table of Benefits above. However, in the event the Covered Person becomes entitled to a refund of all or part of such expenses from any other source, We shall only be liable for the excess of the amount recoverable from such other sources. All medical reimbursement claims must be supported by the original medical bill(s). |

| Daily Hospital Income |

When by reason of Injury (i.e. only when carrying out the recreational sports activities for leisure purpose within Malaysia) the Covered Person requires Confinement in a Hospital, We shall pay the amount of benefit as shown in the Table of Benefits above for each day of hospitalisation, up to a maximum of thirty (30) days from the date of Accident, in respect of one (1) Confinement. Consecutive hospitalisations resulting from the same Injury shall be considered as one (1) Confinement. All Daily Hospital Income claims must be evidenced and supported by Hospital admission and discharge certification and/or original medical bill(s). |

Notes:

You can sign up for this free coverage from 1 August until 30 September 2023.

To be eligible for this free coverage, the customer needs to be:

a) A Malaysian citizen residing in Malaysia; and

b) between the age of 18 and 55.

You can reach out to any AIA Life Planner to sign up through the dedicated microsite.

Provide the relevant information below via the dedicated microsite during the registration period:

If you do not know any AIA Life Planner, please email us at MY.Customer@aia.com and provide your Name, Contact No. and Current Location (e.g., Kepong, Kuala Lumpur) and include “Free Lifestyle Sports Cover” in the email subject.

The coverage period of this free coverage is effective upon successful registration until 31 October 2023, or upon reaching a total claims limit of RM1 million (for AIA Bhd., AIA PUBLIC Takaful Bhd., and AIA General Berhad, combined), whichever is earlier. The total claims limit of RM1 million is aggregated between all the free covers which are offered by Us. AIA reserves the right to withdraw this Free Lifestyle Sports Cover at any time with prior notice.

No. The coverage is only eligible for Malaysians residing in Malaysia only.

No. This Free Lifestyle Sports Cover only covers accident events happen to the Covered Person within Malaysia during the coverage period.

Yes. You can continue to make claims for the benefits provided under this Free Lifestyle Sports Cover if the injury is caused by the same accident event happened during the coverage period, up to the benefit limit stipulated in Table of Benefits under Q1.

This free coverage is valid for 1 accident event during the coverage period only. No benefit is payable for any death or injuries caused by the subsequent and different accident events even though happened within the same coverage period.

Yes. This free coverage does not cover any claim where the basis of the claim is caused directly or indirectly, wholly or partly by any of the following:

Note: Please refer to Appendix 1 for the definition of the capitalized terms.

Your Free Lifestyle Sports Cover will commence on the day your registration on the microsite is successful. If your application is successful, you will receive a welcome email within 14 working days from the registration date.

You will then be required to download the My AIA mobile app via Google Play, App Store or Huawei App Gallery and register your My AIA account. Once completed, you may view your benefits via the My AIA app. You are highly encouraged to download the My AIA mobile app to enjoy higher coverage for this Free Lifestyle Sports Cover.

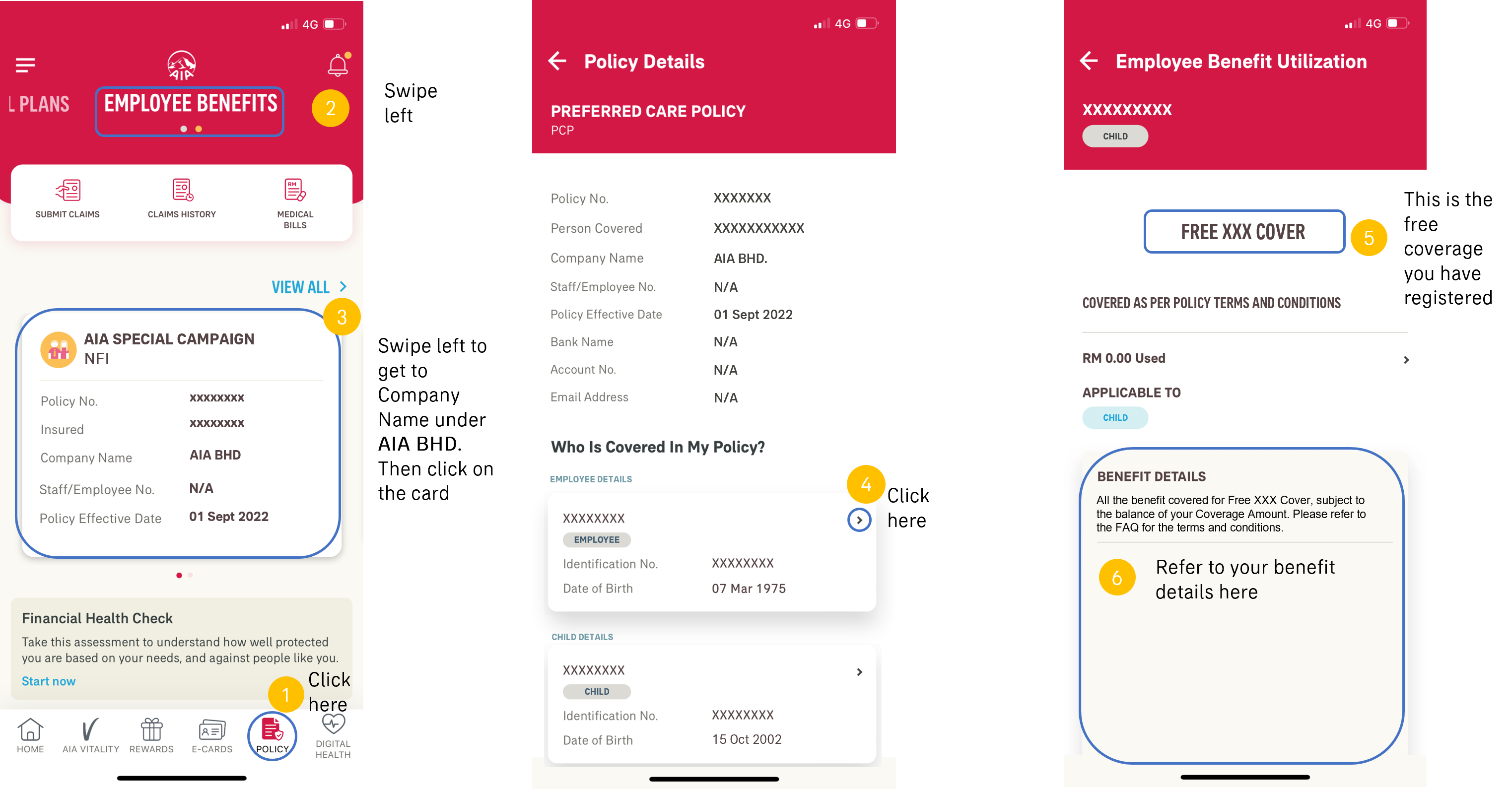

Do not worry. This is where you can view details of your Free Lifestyle Sports Cover in the My AIA App.

Follow the guide below, and you will be able to see that your coverage is shown (point 6) as below:

Please ensure that you have provided the correct information via the dedicated microsite when you sign up for this free coverage, including full name as per NRIC, NRIC Number, phone number and e-mail address.

If you are unsure, please resubmit the application with the correct information and contact your respective AIA Life Planner or e-mail MY.Customer@aia.com “Free Lifestyle Sports Cover” in the email subject for assistance.

For accidental death and dismemberment claim:

For medical reimbursement or daily hospital income claims:

Table of Documents

List of documents required when submitting a claim:

|

Type of Claim |

Documents |

|

For all types of claims |

|

| Additional documents for: | |

| Accidental Death |

|

| Accidental Dismemberment |

|

| Medical Reimbursement |

|

|

Daily Hospital Income |

|

Note:

1. Claim must be submitted within 60 days from the accident/ diagnosis date.

2. We may request additional information and/or supporting documents when required; your early response will expedite the processing of your claim.

One of the reasons is you may have provided incorrect information during the claims application. Please resubmit the claim application with the correct information and contact your respective Life Planner or email MY.Customer@aia.com for assistance.

All ages referred to under this free coverage shall be the age of Covered Person’s last birthday.

“Accident” means a sudden, unintentional, unexpected, unusual, and specific event that occurs at an identifiable time and place which shall, independently of any other cause, be the sole cause of bodily Injury.

“Confinement” or “Confined in a Hospital” shall mean admission in a Hospital for a minimum period of six (6) hours upon the recommendation of a Physician and continuous stay in the Hospital prior to the Covered Person’s discharge. Confinement shall be evidenced by a daily room/room and board charged by the Hospital.

“Hazardous Activity” refers to mountaineering or abseiling necessitating the use of ropes and other climbing equipment, offshore activities beyond five (5) kilometers off any coastline and including rafting or canoeing involving white water rapids, bungee jumping, flying or other aerial activities (unless as a fare-paying passenger in a fully licensed aircraft), underwater activities involving the use of any artificial breathing apparatus to a depth of more than eighteen (18) metres, horseback polo playing, steeple chasing, any form of martial arts, racing (other than on foot or swimming) or trial of speed or reliability, ski-jumping, ski-bob racing, freestyle skiing including the use of bob sleighs, professional sporting activities and competitions of any kind, any organised sporting holiday and any other activities that require a degree of skill.

“Hospital” shall mean only an establishment duly constituted and registered as a Hospital for the care and treatment of sick and injured persons as paying bed-patients, and which:

(a) has facilities for diagnosis and major surgery;

(b) provides twenty-four (24) hour a day nursing services by registered and Graduate Nurses;

(c) is under the supervision of a Physician; and

(d) is not primarily a clinic; a place for alcoholics or drug addicts; a nursing, rest or convalescent home or a home for the aged or similar establishment.

“Injury” means bodily Injury caused solely by Accident.

“Covered Person” shall mean the person(s) covered whom must meet the following eligibility and has/have successfully applied for this free coverage:

“Licensed Nurse” or “Graduate Nurse” shall mean any person that upon successful completion of a recognised college or school of nursing, is legally authorised by the government of the geographical area of his/her practice to render nursing services, but excluding a Licensed Nurse or Graduate Nurse who is the Covered Person himself, an insurance agent/authorised insurance intermediary, business partner(s) or employer/employee of the Covered Person or a member of the Covered Person’s immediate family or related in similar fashion to the Owner.

“Medically Necessary” means a medical service which is:

(a) consistent with the diagnosis and customary medical treatment for a covered disability and/or Injury;

(b) in accordance with standards of good medical practice, consistent with current standard of professional medical care, and of proven medical benefits;

(c) not for the convenience of the Covered Person or the Physician, and unable to be reasonably rendered out of Hospital (if admitted as an in-patient);

(d) not of an experimental, investigational or research nature, preventive or screening nature; and

(e) for which the charges are fair and reasonable and customary for the disability and/or Injury.

“Physician”, “Registered Medical Practitioner” or “Surgeon” shall mean any person qualified by degree in western medicine and who is legally authorised in the geographical area of his practice to practise medicine and surgery, but excluding the Covered Person himself, an insurance agent/authorised insurance intermediary, business partner(s) or employer/employee of the Covered Person or a member of the Covered Person’s immediate family or related in similar fashion to the Owner.

“Reasonable and Customary” shall mean any medical fee or expense which is charged for treatment, supplies or medical services Medically Necessary to treat an Covered Person’s condition under the care, supervision or order of a Physician; does not exceed the usual level of charges for similar treatment, supplies or medical services in the locality where the expense is incurred; and does not include charges that would not have been made if no insurance existed.

Whenever the context requires, masculine form shall apply to feminine and singular term shall include the plural.