Life Protection

Protect yourself and your loved ones from life's uncertainties with AIA's life insurance and takaful plans.

{{title}}

{{label}}The Free Hajj and Umrah Cover supports the Covered Person’s pilgrimage journey by providing death coverage during the Covered Person’s Hajj or Umrah trip.

Table of Benefits

| Benefits | Amount of Benefit | |

| My AIA app User | Non-My AIA app User | |

| Death Benefit | RM2,000 | RM1,000 |

| Accidental Death Benefit | RM4,000 | RM2,000 |

| Badal Hajj Death Benefit | RM1,000 | RM500 |

| Benefits | Description |

| Death Benefit | In the event the Covered Person dies during the Hajj or Umrah trip, We shall pay the amount of benefit as shown in the Table of Benefits. |

| Accidental Death Benefit | In the event the Covered Person dies due to an Accident during the Hajj or Umrah trip, We shall pay the amount of benefit as shown in the Table of Benefits. |

| Badal Hajj Death Benefit |

In the event the Covered Person dies before he is able to perform Hajj, We shall pay

the amount of benefit as shown in the Table of Benefits for the family to arrange

Badal Hajj for the deceased Covered Person.

Badal Hajj means to hire someone to perform Hajj on behalf of another person. The person who performs Badal Hajj must be Muslim and had performed Hajj in the past. |

Notes:

You can sign up for AIA’s Free Hajj and Umrah Cover from 1 June 2023 until 31 July 2023.

To be eligible for this coverage, one needs to be:

Note: Only parents or the legal guardians can sign up for this free coverage for children under their care.

You can reach out to any AIA Life Planner to sign up through the dedicated microsite.

Provide the relevant information below via the dedicated microsite during the registration period:

*Note: Only parents or the legal guardians are allowed to sign up for this free coverage for children under their care. For those with more than 3 children under their care, please register using a fresh registration form.

If you do not know any AIA Life Planners, please email us at MY.Customer@aia.com and provide your Name, Contact Number and Current Location (e.g. Kepong, Kuala Lumpur) and include “Free Hajj and Umrah Cover” in the email subject.

Your coverage will start on 12 June 2023 or on the registration date, whichever is later, i.e.:

No. Free Hajj and Umrah Cover is only eligible for Malaysians who are residing in Malaysia.

No. Coverage for Death Benefit and Accidental Death Benefit starts only after the Covered Person has commenced his Hajj or Umrah trip, i.e., after he enters the international border when travelling to Saudi Arabia.

Yes. The Death Benefit and Accidental Death Benefit are payable if death happens before the Covered Person exits the international border at the destination where the Covered Person departs from Saudi Arabia, as long as the trip is for Hajj or Umrah purpose.

Yes, if the supporting claim documents such as offer letter to perform Hajj, airline ticket, flight itinerary, boarding pass or proof of hotel/accommodation booking can be provided.

Please refer to Question 15 for the list of documents required for claims submission.

No. A claim under the Free Hajj and Umrah Cover is only payable for one benefit.

This free coverage does not cover any death claim if death happened due to suicide.

If your application is successful, you will receive a welcome email within 14 working days from the registration date.

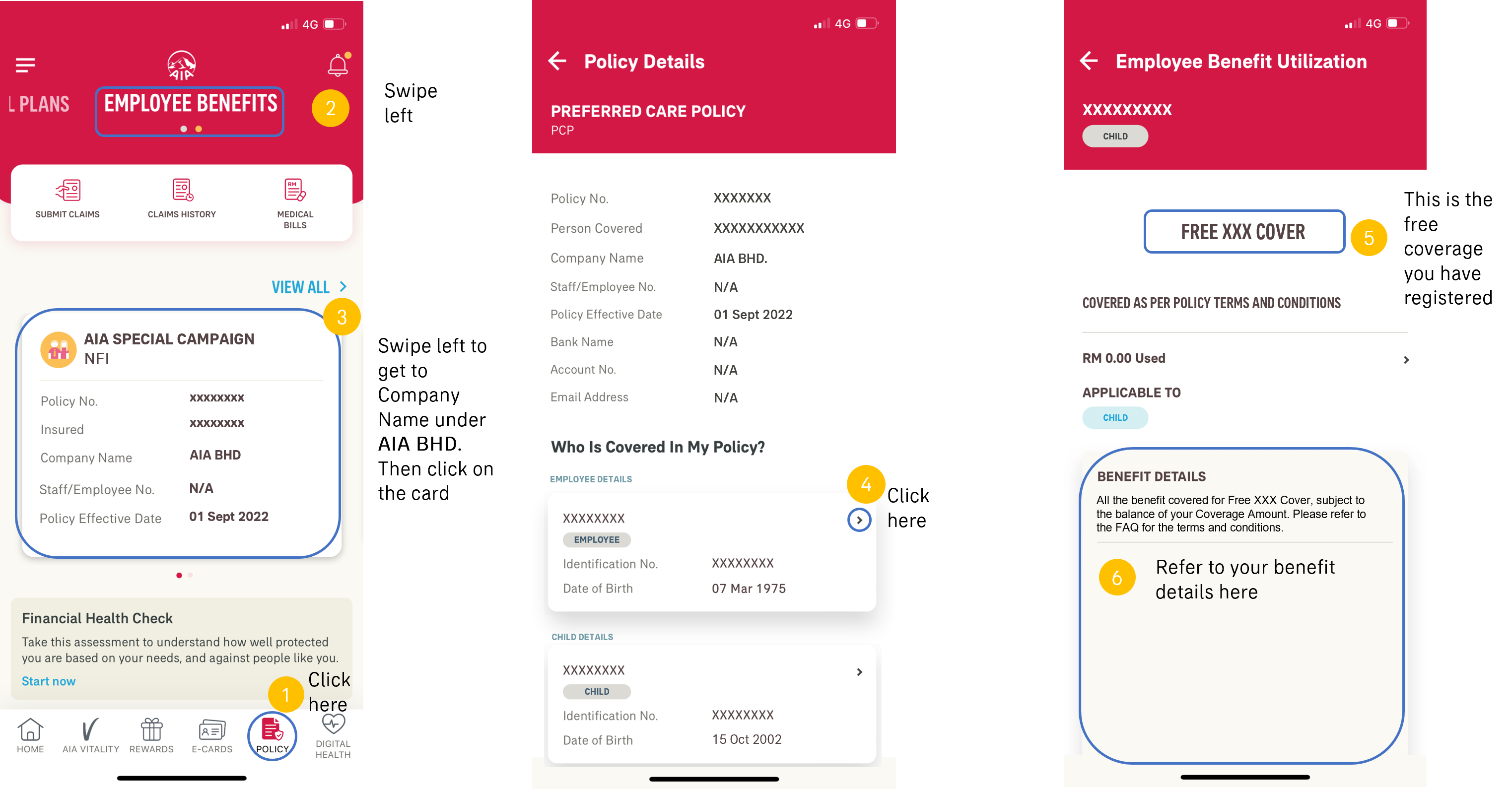

You will then be required to download the My AIA mobile app via Google Play, App Store or Huawei App Gallery and register your My AIA account. Once completed, you may view your benefits via the My AIA app. You are highly encouraged to download the My AIA mobile app to enjoy higher coverage for this Free Hajj and Umrah Cover.

Do not worry. This is where you can view details of your Free Hajj and Umrah Cover in the My AIA App.

Follow the guide below and you will be able to see that your coverage is shown (point 6) as below:

Please note that the fields/terminology(s) within the My AIA app such as Policy/Certificate No., Policy/Certificate Owner, Company Name, Staff/Employee No., Company Effective Date are NOT applicable for this Free Hajj and Umrah Cover as the Free Hajj and Umrah Cover is not an insurance/takaful benefit.

Please ensure that you have provided the correct information via the dedicated microsite when you sign up for this free coverage, including full name as per NRIC, NRIC Number, phone number and e-mail address.

If you are unsure, please resubmit the application with the correct information and contact your respective AIA Life Planner or e-mail MY.Customer@aia.com and include “Free Hajj and Umrah Cover” in the email subject for assistance.

Table of Documents

List of documents required when submitting a claim:

| Documents |

|

Notes:

The claimant may have entered the incorrect information during the claims application. Please resubmit the claim application with the correct information and contact your respective Life Planner or email MY.Customer@aia.com for assistance.

All ages referred to under this free coverage shall be the age of Covered Person’s last birthday.

“Accident” means a sudden, unintentional, unexpected, unusual, and specific event that occurs at an identifiable time and place which shall, independently of any other cause, be the sole cause of bodily Injury.

“Covered Person” shall mean the person(s) who must meet the following eligibility and has/have

successfully applied for this free coverage:

• Age last birthday at the time of registration is between fifteen (15) days old and fifty (50)

years old; and a Malaysian citizen residing in Malaysia.

“Injury” means bodily Injury caused solely by Accident.

“We”, “Our” or “Us” shall mean AIA Bhd., AIA PUBLIC Takaful Bhd., and AIA General Berhad.

Whenever the context requires, masculine form shall apply to feminine and singular term shall include the plural.