Life Protection

Protect yourself and your loved ones from life's uncertainties with AIA's life insurance and takaful plans.

{{title}}

{{label}}The Free PA Boost is a welcome gift for your purchase of policy/certificate under the ‘Healthy You, Wealthy You’ or ‘Cover Kaw Kaw Merdeka Edition’ campaign during the Campaign Period, which is 1 August 2023 to 31 August 2023.

Both the policy/certificate owner and the insured/person covered for the policy/certificate purchased and activated by 15 September 2023 under the ‘Healthy You, Wealthy You’ or ‘Cover Kaw Kaw Merdeka Edition’ campaign are eligible for the Free PA Boost.

In addition, to be eligible for this coverage, one also needs to be:

The Free PA Boost supports the Covered Person’s recovery from an Accident with the following coverage when the Covered Person suffers from an Injury due to an Accident within Malaysia.

Table of Benefits

| Benefits | My AIA app User | Non-My AIA app User |

| Alternative Treatment Benefit |

RM1,000 *Shared limit |

RM500 *Shared limit |

| Accidental Medical Reimbursement | ||

| Corrective Dental and Cosmetic Surgery | ||

| Broken Bones and Burns Benefit | RM2,000 | RM1,000 |

*Shared limit refers to the total amount of benefit payable for Alternative Treatment Benefit, Accidental Medical Reimbursement and Corrective Dental and Cosmetic Surgery Benefit combined.

| Benefits | Description | |||||||||

| Alternative Treatment |

In the event the Covered Person requires treatment by an Acupuncturist, Bonesetter,

Chiropractor or Osteopath following the Injury due to an Accident, we will reimburse

the Reasonable and Customary expenses incurred but not to exceed the amount of

benefit as shown in the Table of Benefits above. This is provided that the treatment is sought after the first consultation by a Registered Medical Practitioner and upon satisfactory proof of bone fractures by X-ray, if required by Us. |

|||||||||

| Accidental Medical Reimbursement | In the event the Covered Person requires treatment by a Registered Medical Practitioner or Surgeon, Confinement in a Hospital or the employment of a Licensed Nurse or Graduate Nurse following the Injury due to an Accident, We shall reimburse the Reasonable and Customary expenses incurred for medical treatment, surgery, Hospital charges, nursing fees, medical/specialist report fees and ambulance fees, but not to exceed the amount of benefit as shown in the Table of Benefits above. | |||||||||

| Corrective Dental and Cosmetic Surgery |

In the event the Covered Person requires corrective dental surgery for replacement

or repair of sound natural teeth or cosmetic surgery performed on the neck, head or

chest following the Injury due to an Accident, We shall reimburse the Reasonable and

Customary expenses incurred but not to exceed the amount of benefit as shown in the

Table of Benefits above. Such treatment must be recommended and performed by a licensed and legally registered orthodontist, cosmetic surgeon, or Registered Medical Practitioner. |

|||||||||

| Broken Bones and Burns |

In the event the Covered Person suffers from Bone Fractures or Second-Degree to

Third-Degree Burns as shown in the table below due to an Accident, We pay the amount

of benefit as shown in the Table of Benefits above. Bone Fractures:

Burns:

|

Notes:

The coverage period of this free coverage is effective until 31 October 2023, or upon reaching a total claims limit of RM1 million (aggregated between all the free covers offered by AIA Bhd., AIA PUBLIC Takaful Bhd., and AIA General Berhad), whichever is earlier. AIA reserves the right to withdraw this Free PA Boost at any time with prior notice.

No. This Free PA Boost only covers Accidents which happen to the Covered Person within Malaysia during the coverage period.

Yes. You may make claims for Accidental Medical Reimbursement, Alternative Treatment and Corrective Dental and Cosmetic Surgery if they are caused by the same Accident, up to a total shared limit of RM1,000*. You may also make a claim for the Broken Bones and Burns Benefit if it is caused by the same Accident, up to RM2,000*.

*Note: These benefit amounts are applicable if you are a My AIA app user. The benefit amounts will be lower for non-My AIA app users. Please refer to the Table of Benefits in Question 1 for more details.

No. This Free PA Boost only covers one accidental event. However, you may make a claim for all the benefits if the Injury is caused by the same Accident which happened during the coverage period, up to the benefit limit stipulated in the Table of Benefits under Question 1.

No. All types of fractures are covered, except hairline fractures and dislocation.

“Second Degree Burns” shall mean the skin damage extends through the epidermis layer of the skin to the dermis layer causing formation of blisters.

“Third Degree Burns” shall mean the full thickness of skin destruction due to burns.

Please refer to Appendix 1 for the full list of definition of the capitalised terms.

The following exclusions are applicable:

You will receive a welcome email within 14 working days from the in-force date of the policy/certificate purchased under the ‘Healthy You, Wealthy You’ or ‘Cover Kaw Kaw Merdeka Edition’ campaign.

You will then be required to download the My AIA mobile app via Google Play, App Store or Huawei App Gallery and register your My AIA account. Once completed, you may view your benefits via the My AIA app. You are highly encouraged to download the My AIA mobile app to enjoy higher coverage for this Free PA Boost.

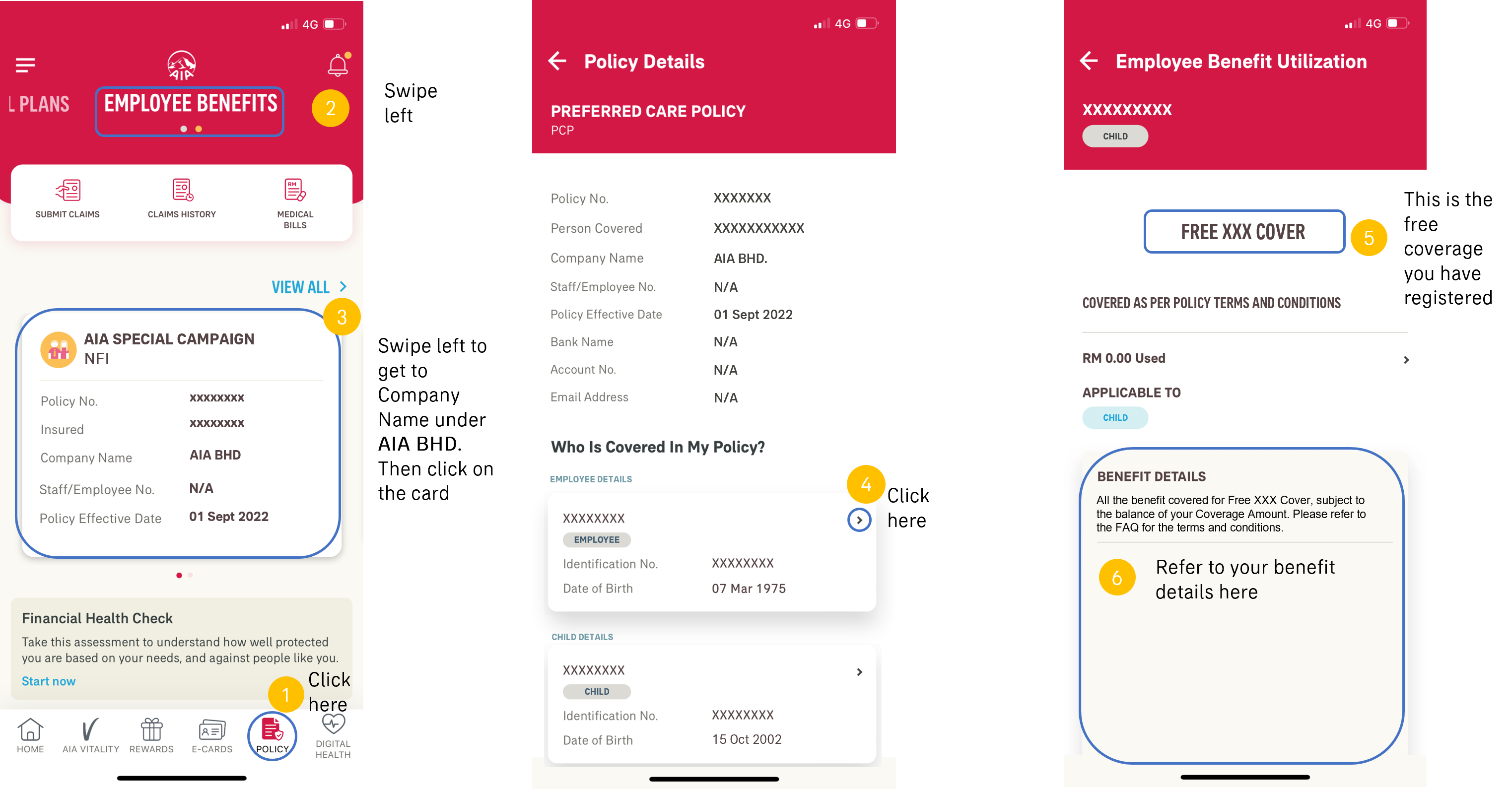

Do not worry. This is where you can view details of your Free PA Boost in the My AIA App.

Follow the guide below and you will be able to see that your coverage is shown (point 6) as below:

Please note that the fields/terminology(s) within the My AIA app such as Policy/Certificate No., Policy/Certificate Owner, Company Name, Staff/Employee No., Company Effective Date are NOT applicable for this Free PA Boost as the Free PA Boost is not an insurance/takaful benefit.

Please ensure that the details for your My AIA account registration are consistent with those provided during your purchase of policy/certificate under the ‘Healthy You, Wealthy You’ or ‘Cover Kaw Kaw Merdeka Edition’ campaign, including full name as per NRIC, NRIC Number, phone number and e-mail address.

If you are unsure, you may contact your respective AIA Life Planner or e-mail MY.Customer@aia.com and include “Free PA Boost” in the email subject for assistance.

Table of Documents

List of documents required when submitting a claim:

| Documents |

|

Notes:

You may have entered the incorrect information during the claims application. Please resubmit the claim application with the correct information and contact your respective Life Planner or email MY.Customer@aia.com for assistance.

All ages referred to under this free coverage shall be the age of Covered Person’s last birthday.

“Accident” means a sudden, unintentional, unexpected, unusual, and specific event that occurs at an identifiable time and place which shall, independently of any other cause, be the sole cause of bodily Injury.

“Acupuncturist”, “Bonesetter”, “Chiropractor” or “Osteopath” shall mean any person rendering medical services of that specific profession and is duly registered under the Traditional and Complementary Medicine Act 2016, the Allied Health Professional Act 2016 (including any re-enactments and/or amendments made thereof for the time being in force) or any prevailing or future laws or regulations, but excluding the Covered Person himself, an insurance/takaful agent/authorised insurance/takaful intermediary, business partner(s) or employer/employee of the Covered Person or a member of the Covered Person's immediate family or related in similar fashion to the Covered Person.

“Confinement” or “Confined in a Hospital” shall mean admission in a Hospital for a minimum period of six (6) hours upon the recommendation of a Physician and continuous stay in the Hospital prior to the Covered Person's discharge. Confinement shall be evidenced by a daily room/room and board charged by the Hospital.

“Covered Person” shall mean the person(s) eligible for Free PA Boost who:

“Hazardous Activity” refers to mountaineering or abseiling necessitating the use of ropes and other climbing equipment, offshore activities beyond five (5) kilometers off any coastline and including rafting or canoeing involving white water rapids, bungee jumping, flying or other aerial activities (unless as a fare-paying passenger in a fully licensed aircraft), underwater activities involving the use of any artificial breathing apparatus to a depth of more than eighteen (18) metres, horseback polo playing, steeple chasing, any form of martial arts, racing (other than on foot or swimming) or trial of speed or reliability, ski-jumping, ski-bob racing, freestyle skiing including the use of bob sleighs, professional sporting activities and competitions of any kind, any organised sporting holiday and any other activities that require a degree of skill.

“Hospital” shall mean only an establishment duly constituted and registered as a Hospital for the care and treatment of sick and injured persons as paying bed-patients, and which:

“Injury” means bodily Injury caused solely by Accident.

“Licensed Nurse” or “Graduate Nurse” shall mean any person that upon successful completion of a recognised college or school of nursing, is legally authorised by the government of the geographical area of his/her practice to render nursing services, but excluding a Licensed Nurse or Graduate Nurse who is the Covered Person himself, an insurance/takaful agent/authorised insurance/takaful intermediary, business partner(s) or employer/employee of the Covered Person or a member of the Covered Person’s immediate family or related in similar fashion to the Covered Person.

“Medically Necessary” means a medical service which is:

“Physician”, “Registered Medical Practitioner” or “Surgeon” shall mean any person qualified by degree in western medicine and who is legally authorised in the geographical area of his practice to practise medicine and surgery, but excluding the Covered Person himself, an insurance/takaful agent/authorised insurance/takaful intermediary, business partner(s) or employer/employee of the Covered Person or a member of the Covered Person's immediate family or related in similar fashion to the Covered Person.

“Reasonable and Customary” shall mean any medical fee or expense which is charged for treatment, supplies or medical services Medically Necessary to treat a Covered Person’s condition under the care, supervision or order of a Physician; does not exceed the usual level of charges for similar treatment, supplies or medical services in the locality where the expense is incurred; and does not include charges that would not have been made if no insurance/takaful existed.

“Second Degree Burns” shall mean the skin damage extends through the epidermis layer of the skin to the dermis layer causing formation of blisters.

“Third Degree Burns” shall mean the full thickness of skin destruction due to burns.

“We”, “Our” or “Us” shall mean AIA Bhd., AIA PUBLIC Takaful Bhd., and AIA General Berhad.

Whenever the context requires, masculine form shall apply to feminine and singular term shall include the plural.