Life Protection

Protect yourself and your loved ones from life's uncertainties with AIA's life insurance and takaful plans.

{{title}}

{{label}}We will be changing the auto debit billing cycle for all AIA. Bhd customers effective 15 September 2023 to ensure the continuity of your insurance coverage with AIA.

No. We are only changing the billing cycle which means we will be increasing the billing attempt frequency. There will be no changes to your existing premium amount.

In the previous billing cycle, there were 4 billing attempts on the following scheduled dates: 8th, 15th, 22nd and the 28th of each month (depending on the premium due date). In the new billing cycle, there will be to 20 attempts in a month with the first attempt is made 9 days before the due date. Below is a comparison between the previous and new billing cycle.

Effective 22 January 2024, premium deductions will begin 4 days (previously 9 days) before the premium due date.

No. If you have enrolled for auto debit payment via your debit/credit card, the change of billing cycle will be applied automatically.

The period between billing date and due date is not new as we want to ensure the collection is done in a timely manner so that you continue to have coverage under your insurance policy. This also provides you with sufficient time in case you need time to update / renew your credit / debit card.

The auto debit will automatically deduct the premium, starting from 9 days before the due date. Your auto-debit payment could be made earlier compared to before, depending on your due date.

Effective 22 January 2024, premium deductions will begin 4 days (previously 9 days) before the premium due date.

This may happen if there are unsuccessful deductions for premium that is due, and the eventual successful deduction crosses over to the next month and the next premium deduction also occurs in the same month. Hence you may see auto debit charges twice in the same month.

If you encounter two deductions in one month, this is due to the transition from 4 billing attempts to a maximum of 20 attempts.

Example: If your policy due date is on the 7th of each month

| Paid to Date (PTD) | Billing Cycle | Deduction Date |

| 7 Sep 2023 |

Previous weekly billing (4 attempts) occurring on 8th, 15th, 22nd and 28th of the month |

8 Sep 2023 |

| 7 Oct 2023 |

New daily billing (20 attempts) occuring 9 days before due date Effective 22 January 2024, premium deductions will begin 4 days (previously 9 days) before the premium due date. |

28 Sep 2023 |

| 7 Nov 2023 | 29 Oct 2023 |

For the first month during the transition to daily billing, you may see 2 deductions in the same calendar month on 8 Sep 2023 and 28 Sep 2023. Do note that these 2 deductions are for due dates 7 Sep 2023 and 7 Oct 2023 respectively.

For the subsequent months, there will be only 1 deduction in the same calendar month.

No, the premium amount will be automatically debited on the scheduled deduction dates as determined by AIA Bhd.

Yes, you may login to AIA+ app, click on Service Request on the left panel and select Change Payment Method.

Please take note that direct payment is only applicable for premium payment frequency of quarterly, semi-annually and annually. For monthly premium payment, it must be on auto-debit via credit/debit cards or current/savings account. If you have opted for direct payment, you may make your renewal payment via AIA+ as we no longer accept renewal payment at our customer centres.

However, we highly encourage you to continue with the auto-debit payment mode to ensure that premium payment is on time and automated, therefore no interruption to your coverage.

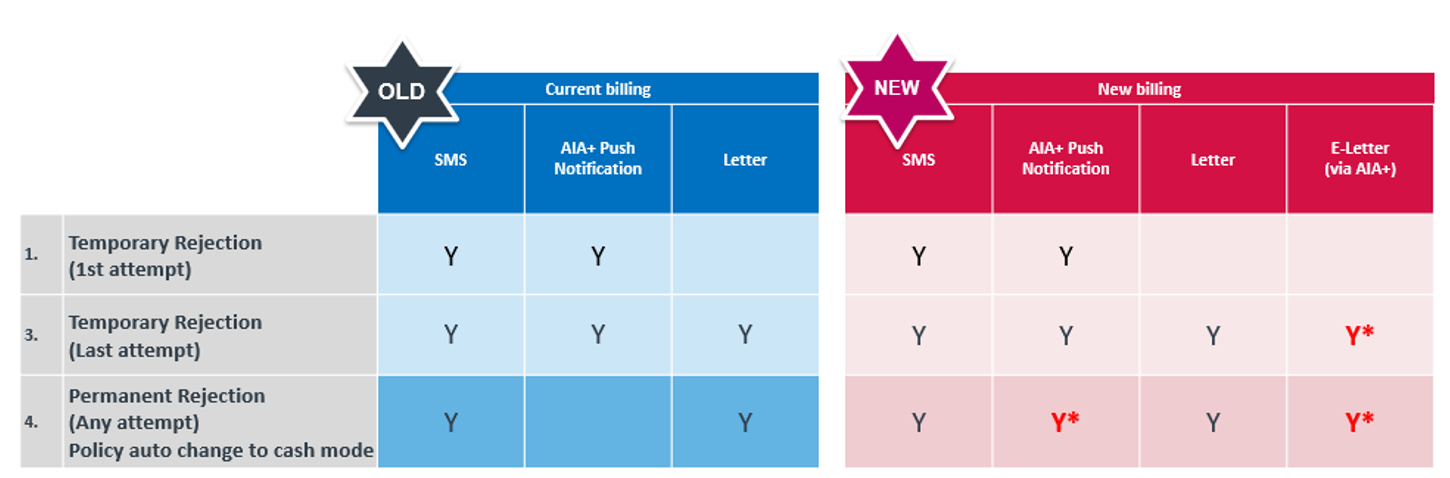

You will receive notifications of rejections via SMS, push notifications and e-letters on AIA+ app and hard-copy letters, depending on whether it is a temporary / permanent rejection and the attempts.

It means that the attempt to bill you is unsuccessful and will be reattempted in the next cycle—this could be caused by insufficient funds in your account.

It means that the attempt to bill you has been unsuccessful and will be converted to cash mode—this could be caused by a stolen or lost credit card.

No, the content of the letter will not specify the reasons for rejection at the moment. However, you may refer to the AIA+ push notification for the reasons of rejections.